Accrual of the simplified tax system (accounting entries). Accrual of the simplified tax system (accounting entries) Advance payment from the buyer to the bank

Calculation of the simplified tax system (postings and applicable accounts) is a seemingly simple question, but sometimes causes difficulties for accountants. Let's consider what transactions are generated in accounting when calculating the simplified tax system.

Accounting under the simplified tax system

Accounting in organizations using the simplified tax system is mandatory. Most often, they belong to small businesses (SMB), and have the right to carry out accounting in a simplified form. In addition, they keep books of income and expenses, which for this taxation system are tax registers.

An accounting register, which is an attribute of both complete ordinary and complete simplified accounting, is understood as a document in which all transactions are systematized by accounts and recorded in chronological order. For example, in account 51, a register is needed so that it can be seen for what purposes the funds were used.

The register forms are approved by the director of the company (Clause 5, Article 10 of Law No. 402-FZ).

The information summarized in the registers is transferred to the turnover sheet, and then to the financial statements. To record information in full simplified accounting, simplified accounting forms can be used - statement forms (Appendices 2-11 to Order of the Ministry of Finance dated December 21, 1998 No. 64n).

When using abbreviated or simple simplified accounting, instead of registers, they use a book for recording the facts of economic activity (Appendix 1 to the order of the Ministry of Finance dated December 21, 1998 No. 64n), and to record wages - form B-8 (Appendix 8 to the order of the Ministry of Finance dated December 21, 1998 No. 64n).

The report on the simplified tax system is prepared in a declaration in the form approved by order of the Federal Tax Service of Russia dated February 26, 2016 N ММВ-7-3/99@.

Read the article about when you need to submit a “simplified” declaration “What are the deadlines for submitting a declaration under the simplified tax system?” .

Accounts used in transactions for calculating tax under the simplified tax system

The reliability of the compiled balance sheet depends on the correctness of the reflection of the company’s economic activities in the accounting documents. This is ensured by accounting entries accompanying each financial transaction. Each fact of the company’s economic life must be recorded in its own way. This will create a perfect balance.

To organize using the simplified tax system, you need to correctly reflect costs and income in accounting. To generate transactions for the accrual and payment of income tax (for both options), the following accounts are used:

- account 51 - all transactions on receipt and debit of funds are recorded on it;

- account 68 - accrue income tax, including quarterly advances on it; records for other taxes are also made here;

- account 99 - reflects the amount of accrued simplified tax.

When calculating the simplified tax system, the following posting is used:

Account 68 can be divided into several sub-accounts, for example:

68.1 - calculations for the simplified tax system;

68.2 - calculations for personal income tax, etc.

A situation is possible when, at the end of the year, the total income tax turns out to be either more than the actual tax amount or less. In the first case, the tax amount must be added, in the second - reduced. The wiring is as follows:

- simplified tax system accrued (posting for advance tax payment) - Dt 99-Kt 68.1;

- advance payment for tax is transferred - Dt 68.1 - Kt 51;

- for the year, additional tax was accrued to the simplified tax system - posting Dt 99 - Kt 68.1;

- The tax according to the simplified tax system for the year was reduced - Dt 68.1 - Kt 99.

The total amount of tax accrued for the year according to the declaration must be equal to the amount reflected in the accruals for the same period in accounts 99 and 68.1. If more advances are transferred than the tax accrued for the year, then the overpayment amount can be returned.

For information on how to write an application for a refund of overpaid tax, read the article “Sample application for refund of overpaid tax” .

Results

Reflection in accounting of accrued tax under the simplified tax system is reflected in synthetic accounts 99 and 68. To maintain analytical accounting for synthetic accounts 68, 99, separate sub-accounts are opened, which must be indicated in the working chart of accounts and approved by the head of the organization (clause 4 of PBU 1/2008 ).

A number of organizations and entrepreneurs have the right to apply the simplified taxation system when conducting economic activities. In this article we will talk about some key points of applying the simplified tax system and consider the main regulatory operations in 1C: Enterprise Accounting 8 edition 3.0 related to the calculation and reporting of the single tax.

So, when using the simplified tax system, you should focus on the following key points:

Applicable object of taxation;

Terms of payment of advances;

Tax reporting deadlines.

The object of taxation under the simplified tax system is the total amount of “income” or the amount of “income minus expenses” for the period. Advance payments are calculated according to the following scheme: taxable object multiplied by the simplified tax system rate applied by the payer.

Based on the results of each quarter, advance payments of the simplified tax system are paid to the budget:

Based on the results of the 1st quarter until April 25;

Based on the results of the 2nd quarter until July 25;

Based on the results of the 3rd quarter until October 25.

The main tax at the end of the year should be paid in accordance with the general rule for submitting a simplified tax system report:

For legal entities until March 31, the year following the reporting year;

For individual entrepreneurs until April 30, the year following the reporting year.

The deadline is postponed to the next working day if the approved date falls on a weekend.

Calculation of advance payments in 1C

Let's look at an example in the table (data are given in rubles). The company operates on the simplified tax system at a rate of 15% of the “income minus expenses” object. Indicators calculated cumulative total:

To automatically calculate advances according to the simplified tax system in 1C: Accounting, use the operation Tax calculation simplified tax system . It is performed during the month-end closing procedure and generates the advance payment amount on the last day of each quarter.

The transactions generated by the operation look like this:

Financial results and advance payment according to the simplified tax system based on the results of the month’s closing:

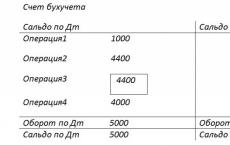

Calculations for the simplified tax system in 1C: Accounting 3.0 are reflected in account 68.12: on credit - accrued amounts, on debit - paid:

When filling out a single tax return, an accountant should pay attention to this nuance. Amount of advances according to lines 270-273 of section 2.2 of the declaration is not adjusted downwards by the amount of tax calculated in previous periods, therefore the amount of the actual advance payment payable quarterly will differ from the declaration figures and looks as follows:

In the 1st quarter – 9573;

In the 2nd – 15315 (24888 – 9573);

In the 3rd – 20166 (45054 – 24888);

At the end of the year – 12600 (57654 – 45054).

Next, the accountant is required to calculate minimum tax at 1% rate

from income for the entire year (without deducting expenses) and compare the result with the amount of the calculated simplified tax system for the year. To do this, let's do the calculations:

879078.42 x 1% = 8791

(879078.42 -494714.64) x 15% = 57654

In our case, there is no need to make additional wiring. But the accountant should remember that, having received a loss based on the results of work for the year, the minimum tax at a rate of 1% on all types of income is paid regardless of the financial results.

If the amount of tax calculated at the rate of 15% is less than the rate of 1%, then you will need to pay the difference. In this case, the program, closing the period, will generate an entry in the accounting register in December for the missing tax amount:

Dt 99.01.1 Kt 68.12

The minimum tax indicator of the simplified tax system is reflected in the declaration according to section 1.2 line 120.

Formation of a declaration according to the simplified tax system in 1C

In order to fill out the declaration, go to the reports menu and find the section in the program 1C-Reporting . A list of reports created during the period will open. We create a new declaration using the button: Create, and select the current version of the report.

In the declaration form that opens, the data appears when you click the button Fill. Let's turn to the information in section 2.2 of line 280. Here is the amount of tax at the minimum simplified tax rate of 1%, but in our case it is not paid, because the tax calculated according to the general rules is greater. The results of advance payments and annual tax calculated in the standard way are reflected in lines 270-273 of this section.

Section 2.2 also contains data on the organization’s income and expenses since the beginning of the year. The program takes information from the generated books of income and expenses according to the simplified tax system

. You can find the book in the general section of the program menu Reports and onwards simplified tax system block

:

In the same section of the program, all the necessary indicators that are involved in the formation of the declaration are clearly presented. If the accountant is confident in the calculations, then at the end of the page there is a button Pay from bank account , highlighted in bright yellow. Here is a link for quick access to the simplified taxation system declaration.

I would also like to draw attention to section 1.2 of the declaration, which reflects the amounts of advance and total tax that the taxpayer will actually pay to the budget. In the program, these amounts are recorded on account 68.12.

Simplified tax system: recognition of income and expenses (1C Accounting 8.3, edition 3.0)

2016-12-08T11:39:01+00:00Today we will look at a topic that raises perhaps the largest number of questions from novice (and not only) accountants - the procedure for recognizing income and expenses under the simplified taxation system (STS) in the 1C: Accounting 8 program family.

We will consider examples in 1C: Accounting 8.3 (edition 3.0). But in the “two” everything works the same way.

A short excursion into theory

We are interested in filling out the book of income and expenses (KUDIR). In this wonderful book:

- Column 4 is the “Total Income” column

- column 5 is “Accepted income”

- column 6 is the column “Total expenses”

- column 7 is “Accepted expenses”

We are primarily interested in columns 5 and 7. They influence the amount of the single tax we pay.

There are two main modes in "simplified":

- income (column 5)

- income (column 5) minus expenses (column 7)

To calculate the single tax, in the first case we simply multiply the amount of income by 6%, and in the second case we multiply the difference between income and expenses by 15%.

That's all in a nutshell.

Correctly calculating income and expenses is the most difficult task. Already based on the presence of four columns “total income” and “accepted income”, “total expenses” and “accepted expenses”, it turns out that not all income and expenses can be taken to calculate the tax.

You need to be able to correctly determine the moment of recognition of income or expense. For the simplified tax system, it is mandatory to use cash method.

Under the cash method, the date of receipt of income is the day the funds are received in bank accounts or at the cash desk. And it doesn’t matter whether it’s an advance or payment. The money has arrived - income has been received, and therefore immediately falls into columns 4 and 5.

As you can see, with income everything is extremely simple. Any receipt of money (to the cash register or to the current account) falls into general and recognized income, on which tax must be paid.

With expenses, things are a little more complicated.

For recognition expenses for purchasing materials- it is necessary to reflect the fact of their receipt and payment.

For recognition expenses for payment of services provided to us- it is necessary to reflect the fact of their provision and payment.

For recognition expenses for purchasing goods for subsequent resale - you need to reflect the fact of their receipt, payment and sale.

For recognition labor costs- you need to reflect the fact of its accrual and payment.

When paying via expense reports- in addition to the above conditions, it is required to reflect the fact of issuing money to the accountable person.

As you can see, for many of the listed situations there are several conditions for recognizing expenses. And these conditions can be met in different orders. In this case, the moment of recognition of the expense will be considered last condition met.

Advance payment from buyer to bank

The buyer transferred money to our bank account as an advance payment (advance payment). According to our assumption (cash method), this amount will immediately fall into “Total Income” (column 4) and “Accounted Income” (column 5):

bank receipt -> column 4 + column 5

We issue a statement (receipt to the current account) for 2000 rubles from the buyer of Magic Hind LLC:

We post and open document transactions (DtKt button). We see that the payment amount was assigned to 62.02 - everything is correct, because this is an advance:

Immediately go to the second tab “Income and Expense Accounting Book”. It is here that payment amounts are posted (or not posted) in the KUDIR columns. We see that the 2000 rubles received immediately fell into columns 4 and 5:

Advance from the buyer at the checkout

With a cash register, everything is similar to a bank. The buyer paid money to the cash register as an advance payment (advance payment). According to our assumption (cash method), this amount will immediately fall into columns 4 and 5:

cash receipt -> column 4 + column 5

We issue a cash receipt order (cash receipt) from the buyer "Svergunenko M.F." for the amount of 3000 rubles:

We post the document and go to its postings (DtKt button). We see that the payment amount was assigned to 62.02 - everything is correct, because this is an advance:

We immediately go to the “Income and Expenses Accounting Book” tab and see that our entire amount falls into columns 4 and 5:

Payment to the supplier for services rendered

Let's move on to expenses. This is where things get more interesting. But not in the case of payment for services provided to us. We just need to enter the act of provision of services and its payment into the program, then the act itself (according to the cash method) will not make any marks in the KUDIR columns, but the bank statement will immediately post the amount of payment in columns 6 and 7:

certificate of provision of services -> will not do anything

payment by bank -> column 6 + column 7

We enter into the program a certificate of provision of services from the supplier Aeroflot in the amount of 2500:

We post the document and go to its postings (DtKt button). We see that expenses (26th invoice) were attributed to 60.01 - everything is correct:

We do not see the “Book of Income and Expenses Accounting” bookmark, which means that the indicated 2500 did not fall into any of the KUDIR columns. Go ahead.

The next day we submit a statement of payment for the services provided to us:

We carry out the statement and look at its postings. We see that the payment amount was applied to 60.01:

We immediately go to the “Income and Expenses Accounting Book” tab and see that the paid 2,500 finally fell into columns 6 and 7:

Advance payment to the supplier for the provision of services

What if we made an advance payment to the supplier for services provided (advance payment)? And only then they issued an act of provision of services. Schematically it will look like this:

payment by bank -> fill in column 6

act of provision of services -> fill out column 7

Let’s enter into the program a bank statement (our advance payment to the supplier) in the amount of 4500:

Let’s post the document and open its postings (DtKt button). We see that the amount fell on 60.02 - everything is correct, because this is an advance:

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the advance amount is included only in column 6:

And it is right. According to the cash method, in column 7 (accepted expenses), we will be able to take this amount only after entering the certificate of provision of services. Let's do it.

We will add an act of service provision to the program the next day:

Let's go through the document and look at the postings:

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the payment amount finally falls into the seventh column:

Payment to the supplier for materials

Important!

Further we will reason like this. We use the cash method. First there was the receipt of materials, then payment by bank. Obviously, it is the payment by bank (since there has already been a receipt) that will create entries in columns 6 and 7. Schematically it will be like this:

receipt of materials -> will not create anything

payment by bank for materials -> fill in column 6 and column 7

Let’s enter into the program the receipt of materials in the amount of 1000 rubles:

We see that the “Income and Expenses Accounting Book” tab does not appear next to the transactions. This means that the materials receipt document in this case did not create records for any of the KUDIR columns.

We will issue a statement of payment for materials the following day:

Let’s post the document and open its postings (DtKt button):

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the document has filled out columns 6 and 7:

Advance payment to the supplier for the supply of materials

Important! First, let's correctly set up the procedure for recognizing expenses in the accounting policy -.

In this case, payment comes first, then materials arrive. According to the logic of the cash method, full recognition of expenses (column 7) will be possible only after both documents have been completed. Schematically it would be like this:

payment by bank for the supply of materials -> fill out column 6

receipt of materials -> fill in column 7

Let’s add into the program a statement about the prepayment for materials for 3,200 rubles:

Let’s post the document and open its postings (DtKt button):

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the statement has so far filled out only column 6 (total expenses):

To fill out the seventh column, the receipt of materials document is missing. Let's format it:

We post the document and look at its postings (DtKt button):

We immediately go to the “Income and Expenses Accounting Book” tab and see that the document receipt of materials has filled in the missing column 7:

Payment to the supplier for goods

Important! First, let's correctly set up the procedure for recognizing expenses in the accounting policy -.

In general, the procedure for recognizing expenses for the purchase of goods for sale is similar to the situation with the receipt of materials - receipt and payment are also required here. But an additional (third) requirement is that expenses are recognized only as purchased goods are sold.

Schematically our scheme will be like this:

goods receipt -> fills nothing

payment for goods by bank -> fill out column 6

sales of paid goods -> fill out column 7

Let’s enter into the program the receipt of goods in the amount of 31,292 rubles:

Let’s post the document and open its postings (DtKt button):

We see that the “Income and Expense Accounting Book” tab is missing, which means the document did not record anything in the KUDIR columns.

Let's enter a statement of payment for goods to the supplier:

Let’s post the document and open its postings:

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the payment amount is included in the total expenses (column 6). This amount will be included in the seventh column (expenses accepted) as the goods are sold.

Let's assume that all the goods are sold. Let's formalize its implementation:

Let’s post the document and open its postings (DtKt button):

Let’s immediately go to the “Income and Expenses Accounting Book” tab and see that the payment amount finally falls into the seventh column:

Advance payment to supplier for goods

Important! First, let's correctly set up the procedure for recognizing expenses in the accounting policy -.

Everything here is similar to paying the supplier for goods (previous point). Except that the payment amount will be included in the sixth column in the first document (bank statement). The scheme will be like this:

payment for goods by bank -> fill in column 6

goods receipt -> will not fill anything

sale of paid goods -> fill in column 7

Payment to the supplier through an advance report

Important! First, let's correctly set up the procedure for recognizing expenses in the accounting policy -.

If, in any of the situations described above, you replace payment by bank with payment through an accountable person, everything will work exactly the same.

But there is a nuance. The main condition for the expenses paid according to the advance report (in addition to those listed above) to be taken into account is the actual issuance of money to the accountable person (expense cash order).

Column 6 will be filled in with the RKO document.

Column 7 will be filled in when the following additional conditions occur: advance report + (act of service provision or receipt of materials or receipt of goods and their sale). Moreover, this column will be filled in with the document that is the latest in date.

Payment of wages

To fill out columns 6 and 7, you must have two documents at once: accrual and payment of wages.

Scheme 1:

payroll -> will not fill in anything

issuance of wages (RKO) -> fill in column 6 and column 7

Scheme 2:

issuance of wages before accrual (RKO) -> fill in column 6

payroll -> fill in column 7

We're great, that's all

By the way, for new lessons...

Sincerely, Vladimir Milkin(teacher and developer

Users often have questions about how to organize accounting in the software program “1C: Enterprise Accounting 8” when combining different tax regimes. This article is devoted to consideration of this issue.

As an example, consider the activities of the trading enterprise Romashka LLC, which is engaged in wholesale and retail trade. Wholesale trade falls under the simplified tax system (STS) (Income-Expenses), retail trade is subject to UTII. Shipment of goods both wholesale and retail is carried out from one general (wholesale) warehouse. Mutual settlements with retail customers are carried out through accounts. 60.

Organization of separate accounting at the enterprise in the software "1C: Enterprise Accounting 8"

In a letter dated November 30, 2011 No. 03-11-11/296, the Russian Ministry of Finance indicated that the Tax Code of the Russian Federation does not establish a procedure for maintaining separate accounting when simultaneously applying UTII and the simplified tax system. That's why Taxpayers independently develop and approve the procedure for maintaining such records. The developed procedure must be enshrined in an order on accounting policies or in a local document approved by an order for the organization (order of an individual entrepreneur), or several documents that together will contain all the rules regarding the procedure for maintaining separate accounting. At the same time, the method of separate accounting used should make it possible to unambiguously attribute certain indicators to different types of business activities.

To implement separate accounting of income and expenses, the program uses the following methods:

- Using different subaccounts of income and expense accounts in the Chart of Accounts.

- Subaccounts ending in 1 are income/expenses attributed to the main taxation system (General or simplified taxation system), ending in 2 are income/expenses attributed to activities with a special taxation procedure (UTII).

Note. Accounting under simplified taxation regimes is carried out on the accounts of the Chart of Accounts, and tax accounting (formation of a declaration according to the simplified tax system, the Book of Accounting for Income and Expenses) on the accumulation register “Expenses of the simplified tax system”. Movements in this register are formed when posting primary documents simultaneously with the formation of accounting entries.

Settings in the “Cost Items” directory. Each cost item indicates which type of activity (taxation system) this expense relates to. Expenses collected for the period on items related to activities with the main system will be closed on the account. 90.02.1 (cost of the main activity, in our example, simplified tax system). Expenses collected for items classified as activities with a special taxation procedure will be closed on the account. 90.02.2 (cost price according to the UTII tax system). Distributed costs, that is, costs that cannot be attributed to a specific type of activity, at the end of the month will be distributed to the debit of the subaccounts of the account. 90.02 in proportion to the income received in accordance with Article 272 of the Tax Code of the Russian Federation.

Important! This setting affects the closure of cost accounts using the “Month Closing” processing and the generation of financial statements and does not affect the filling out of the Income and Expense Book and the Declaration under the simplified tax system.

Field "Expenses (NU)" in the primary documents for the recognition of expenses, it is necessary to fill out in order to distribute expenses according to taxation systems for tax accounting, that is, the formation of KUDiR and filling out the Tax return according to the simplified tax system:

Expenses for tax accounting purposes under the simplified tax system can be:

Using different item groups. When using different types of activities, it is recommended to use different nomenclature groups:

Separation of warehouse accounting(i.e. using a separate warehouse for each activity) is possible, but not necessary.

Recognition of expenses under a simplified taxation system

1. Legislative framework

The list of expenses for which organizations that apply the simplified tax system and have chosen income reduced by the amount of expenses as an object of taxation have the right to reduce received income is given in paragraph 1 of Art. 346.16 Tax Code of the Russian Federation.

Moreover, in contrast to the procedure for taxing the profits of organizations provided for by Chapter 25 of the Tax Code of the Russian Federation, this list is exhaustive, that is, it is closed, therefore the taxpayer does not have the right to include in expenses expenses not named in this list (see, for example, letters from the Ministry of Finance Russia dated 06/04/2012 N 03-11-11/175, dated 12/29/2009 N 03-11-06/2/269, Federal Tax Service of Russia for Moscow dated 11/15/2010 N 16-15/119850).

In addition, it is necessary that the expenses taken into account under the simplified tax system meet the following criteria:

- the expense must correspond to the business profile;

- the expense must be confirmed and paid;

- the expense must be incurred to carry out activities aimed at generating income.

2. Implementation in software "1C: Enterprise Accounting 8"

The procedure for recognizing expenses for tax purposes in the simplified tax system is configured in the Accounting Policies of organizations.

Menu: Enterprise – Accounting policies – Accounting policies of organizations

Events that are not editable are mandatory. All other events must be determined by the user in accordance with the legislation of the Russian Federation and the specifics of their activities.

When making different types of expenses, the program keeps records of whether the expense has passed the entire list of events (statuses) necessary to recognize this expense as reducing the tax base under the simplified tax system.

To store this chain of status passages in the program, the accumulation register “Expenses under the simplified tax system” is used:

For clarity, we will group expenses by type and show movements by status before entering the Income and Expense Book according to the settings of our accounting policy:

| Type of consumption | Event | Status |

|---|---|---|

| 1. Material costs | Inventory receipt | Not written off, Not paid |

| Payment for materials to the supplier | Not written off (ends up in KUDiR) | |

| 2. Expenses for the purchase of goods | Receipt of goods | Not written off, Not paid |

| Payment to the supplier for goods | Gets into KUDiR | |

| Sales of goods to the buyer | ||

| 3. Services | Receipt of service | Not paid |

| Payment to the supplier | Gets into KUDiR | |

| 4. Salary and payroll deductions | Payroll | Not paid |

| Salary payment | Gets into KUDiR | |

| 5. Taxes, fees | Calculation of taxes and fees | Not paid |

| Payment of taxes and fees | Gets into KUDiR |

Note: expenses can go through the statuses in any order, but only the amount of expenses that has passed through all the necessary statuses will be recognized to reduce the tax base.

Distributed expenses will fall into KUDiR only after a regulatory operation for distribution between taxation systems (“Distribution of expenses by type of activity for the simplified tax system”):

Let us consider in the PP “1C: Enterprise Accounting 8” a reflection of the chain of business transactions characteristic of organizations engaged in trading activities.

Formation of primary documents

1. Receipt of goods

This operation is reflected in the document “Receipt of goods and services”:

If the supplier of goods has charged VAT, we include it in the cost of purchased values using the “Prices and currencies” button:

Note! The “Expenses (OU)” field must be filled out. If the field is not filled in, these expenses are considered ineligible for tax accounting purposes.

When posting the document, accounting entries will be generated:

Tax accounting movements in the “Expenses under the simplified tax system” register:

2. Payment to the supplier for goods

We will reflect this operation in the document “Write-off from the current account”:

Entries in the register “Expenses under the simplified tax system”:

Income and expenses under the simplified tax system are recognized using the cash method. Therefore, the amount transferred to the supplier falls into column 6 “Total expenses” of KUDiR. But since the last condition “Sale of goods to the supplier” has not yet been met, these expenses do not yet fall into column 7 (that is, they do not reduce the tax base):

3. Sales of goods to a wholesale buyer

This operation is reflected in the document “Sales of goods and services”:

Note! Income and expense accounts are indicated for the main activity (STS). The corresponding nomenclature group “Wholesale trade” was selected as analytics.

When posting the document, the following transactions will be generated:

The cost of goods sold, including VAT charged by the supplier, falls into the Income and Expense Accounting Book:

It is the generated register “Decoding KUDiR” that, when registering the primary document, signals the inclusion of expenses in the tax base according to the simplified tax system.

Since the organization uses one common warehouse for wholesale and retail trade, sales of both wholesale and retail will be reflected in the document “Sales of goods and services” (the document “Report on Retail Sales” is intended only for sales from a warehouse with the type “Retail” ).

note to fill out income and expense accounts for activities subject to UTII (90.01.2, 90.02.2), and to select the appropriate nomenclature group “Retail trade”.

When posting the document, the following transactions will be generated:

When combining the simplified tax system and UTII modes, expenses and income from UTII are recorded by the program in the auxiliary off-balance sheet account USN.01 “Settlements with customers for UTII activities.”

During this process, a register “Expenses under the simplified tax system” is also formed with the expense write-off status “Not accepted”:

5. Receiving payment from a retail buyer

To reflect this operation, we enter the document “Cash receipt order” with the type of operation “Payment from the buyer”:

When posting a document, transactions and movements will be generated in the “Income and Expenses Accounting Book” register:

The received retail revenue falls into column 4 “Total income”:

6. Receiving an advance from the buyer

We will reflect this operation using the document “Receipt to the current account”:

When receiving an advance from the buyer (for non-cash or cash payment), in the document you must pay attention to filling out the field “Reflection of the advance in NU”. Attribution to one or another tax regime will depend on filling out this field.

When posting the document, the following transactions will be generated:

7. Receipt of service

Let us reflect the service for the delivery of goods using the document “Receipt of goods and services”:

The costs of delivery of goods are allocated. To distribute costs between taxation systems according to tax accounting, in the “Expenses (NU)” field, indicate “Distributed”.

For accounting purposes, we will show the program that these costs need to be distributed by selecting a distributed cost item.

Delivery costs will be charged to the account. 44, as an analytics we will select the cost item “Delivery”:

8. Tax calculation

The accrual of taxes and fees in the program is reflected in the document “Operation (accounting and tax accounting)”:

9. Paying taxes

Let's transfer the advance according to the simplified tax system using the document “Write-off from current account” with the type of operation “Tax transfer”:

When posting the document, the following transactions will be generated:

Entries in the register “Income and Expense Accounting Book”:

<Расход по уплате налога попал только в 6 графу, хотя было выполнено оба условия: начисление налога и оплата налога. Дело в следующем: так как начисление налогов осуществляется ручной операцией, при ее записи не формируются движения в регистр «Расходы при УСН», поэтому программа данное начисление «не видит». Для таких случаев в документах поступления и списания с расчетного счета, приходных и расходных кассовых ордерах предусмотрена кнопка «КУДиР». Эта кнопка предназначена для ручной корректировки данных, попадающих в книгу учета доходов и расходов:

When you click the button, the following window opens:

If manual correction of the book is required, this checkbox must be unchecked. In the form that opens, you must manually indicate the reflection of payments for the purposes of the simplified tax system and UTII:

Note. The “KUDiR” button is not active for all types of transactions of payment documents (in particular, it can be used when reflecting transactions with the type “Other income/expense”, “Tax transfer”).

To manually fill out the Income and Expense Book, the document “Records of the Income and Expense Book (STS, patent)” is intended. In particular, this is necessary for business transactions reflected in the program by the document “Operation (accounting and tax accounting)” (for example, tax calculation).

Closing the period. Formation of accounting and tax reporting

Before closing the month for tax accounting purposes under the simplified tax system, it is necessary to distribute expenses among different types of activities. For this purpose, the program provides a regulatory operation “Distribution of expenses by type of activity for the simplified tax system.”

Menu: Operations – Routine operations

Distribution is made in proportion to the income received for each type of activity:

When carrying out a regulatory operation, registers will be created according to the simplified tax system. These registers will generate movements in tax reporting for distributed expenses (in terms of accepted expenses under the simplified tax system):

To close a period for accounting purposes, you need to run the “Month Closing” processing:

For accounting purposes, the allocated costs for the received service were also distributed between taxation systems:

To decipher the results obtained from accounting data, you can use the “Reference-Calculation” report: “Write-off of indirect expenses (accounting)” and “Financial results (accounting)”:

To analyze the results of activities based on tax accounting data, the report “Analysis of the state of tax accounting according to the simplified tax system” is intended:

For each component of income and expenses, you can view a transcript (the transcript is called by double-clicking on the indicator of interest):

All income and expenses that are not included in this report will accordingly not be included in the Book of Income and Expenses and in the Declaration under the simplified tax system.

As a result of these actions, we receive automatically generated reports “Income and Expense Accounting Book”:

Menu: Reports - Book of accounting of income and expenses according to the simplified tax system

Declaration according to the simplified tax system:

Menu: Reports - Directory “Regulated reports”