If it is necessary to reverse the sale, what documents should I attach? Correct reversal of documents Reversal of receipts in 1s 8.3 accounting

In this article, we will look at the concept of “reversal” (“red reversal”) in Russian accounting, and how to make a reversal in 1C Accounting 8.3.

Methodological and historical aspects

Storno is a way of adjusting data in accounting (from Italian stornare– withdraw, turn back). The term reverse (reverse) is actively used, which can be called a synonym for the word minus. Incorrectly entered entries* (they entered an extra document, made a mistake with correspondence, indicated an inflated amount) are subject to zeroing, for this purpose such entries are reflected in accounting with a negative sign.

*The term reverse is not always used in case of errors. Sometimes, if during a period accounting is carried out at planned prices, and then they are adjusted to actual prices, it becomes necessary to reduce the amount. In this case, the term “reverse” is also applicable.

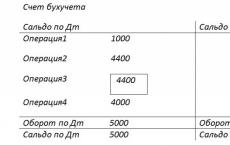

Previously, when accounting was kept manually, in the turnover or accounting books, when errors were discovered, the incorrect amount was not crossed out, but was additionally written down in red ink. If red ink was not at hand, then such amounts were written down and circled in a rectangular frame. When calculating the overall totals, the amounts written in red should have been subtracted, or, in professional terms - reverse the amount. It looked something like this:

Example 1: Account turnover, the amount of 1000 is correct, instead of the amount of 4000 they indicated 4400 (Operation 2).

Option 1

Option 2

The color reversal method was first described in 1889 by Alexander Aleksandrovich Beretti, and in Russian accounting a stable phrase has emerged - “red reversal”.

Theoretically, you can reset an erroneous entry by swapping debit and credit, creating a so-called reverse reversal. This approach creates the correct final balance, but the amount of turnover on the accounts will be overestimated, which will lead to some unreliability of the accounting information. By changing our example, you can clearly see this:

Option 3

Sometimes the method of correcting errors by reverse posting is called “black reversal,” although this term cannot be called official. Moreover, there are options for action here too. It is possible, as in option number three (if the accounts are correctly corresponded), to indicate only the delta between the correct and deposited amount and not create additional correct postings (Operation 3).

Option 4

The reverse reversal method is usually used in credit institutions or Western accounting systems. In Russian accounting, by default, reversal is most often understood as “red reversal”. Legislatively, for example, in the accounting law, the term reversal does not appear. The procedure for correcting errors is described in PBU 22/2010, but there is no term for reversal there either. At the same time, in other acts of legislation, mainly related to budgetary or autonomous organizations, the text directly refers to the red reversal method as a method for correcting errors. Based on the practice that has developed in our country of reversing erroneous documents, we will further understand the term “reversal” as “red reversal”.

Automation and reversal

When accounting was transferred to the area of automated processes, that is, when accounting was done on a PC, they began to generate postings with a minus sign (the correspondence of accounts did not change), and in the turnover, for better visualization, they left the red color for negative values. On some reporting forms you may see an instruction to show negative numbers in parentheses. When calculating the totals, we know that we must subtract them.

Note that if, as a result of an error, an underestimated amount was indicated, and the correspondence of accounts is correct, then an option is possible when the reversal method is not applied, but an additional entry is simply created for the difference in the amount.

Let us pay attention to an important nuance that determines the specifics of modern accounting using 1C. When posting a document in the program, transactions are generated in accordance with the chart of accounts. They are called that - accounting entries, which will ultimately show the amounts of assets and liabilities on the balance sheet. But the financial service also needs to fill out tax returns, reports to funds and other registers that are not methodologically tied to the chart of accounts and can be formed according to completely different principles. A stable term “tax accounting” has appeared, data for which should be generated in accordance with the Tax Code (accounting data is generated in accordance with PBU - Accounting Regulations). In 1C, in settings and postings you can often see the abbreviations BU (accounting) and NU (tax accounting). In addition, there are additional intermediate registers. For example, data for the purchase and sales ledger is generated in similar registers. Therefore, the reversal of documents should affect not only transactions related to accounting and tax accounting - the registers must also be filled out correctly.

Creating reversal documents in 1C 8.3

Let's look at reversing documents in 1C using the example of a vacation accrual situation.

Example 2: In November 2017, an employee was accrued vacation pay in the amount of 30,000, but should have indicated the amount of 25,000. The reversal operation in 1C 8.3 will be in December 2017.

Transactions => Transactions entered manually

Figure 1 Menu path

Button Create displays a list of allowed actions, select Reversal of the document.

Figure 2 Creating a Reversal document

Figure 2 Creating a Reversal document

Then you must specify the document to be reversed.

Figure 3 Filling out the reversal document

Figure 3 Filling out the reversal document

First, select the document type, then the document itself.

Figure 4 Selecting a document type

Reversal postings are generated automatically.

Figure 5 Reversal transactions generated

Please note that in addition to accounting and tax accounting data, other accounting registers are filled out.

Figure 6 Filling data registers

If suddenly some accounting register is not automatically included in the reversal document, you can add it manually. To do this, in the menu buttons More need to press Register selection... and select the appropriate one from the list.

Figure 7 Register filling service

Printed form of the document Reversal – accounting certificate.

Figure 8 Accounting statement for the reversal document

It should be noted that the technical side of reversal of release in 1C was shown here. In practice, it is often impossible to simply reduce and recover from an employee amounts already paid, since it is necessary to take into account the provisions of Art. 137 labor code.

Reversal of implementation in 1C

For documents from the section Implementation reversal in 1C is performed according to the above algorithm. Reversing the sales of the previous period will generate accounting entries automatically and correctly, but reversing VAT in tax accounting will require additional settings.

Example 3: in September 2017, an act and invoice were issued for services rendered in the amount of 11,800 rubles, incl. VAT 1,800 rub. The accountant processed these documents. The counterparty did not sign the work completion certificate in September, and agreed to do so only in November 2017. The September document should be reversed.

To correctly account for VAT, along with reversing the document in accounting, you should fill out an additional sheet to the sales book for the 3rd quarter of 2017. In this additional sheet, the erroneous invoice will be cancelled. Please note that the VAT adjustment document itself will be created in November 2017, but it will indicate the adjustment period - the 3rd quarter of 2017. Based on the adjusted data, it will be possible to fill out an updated VAT return, in which Section 9 will appear.

In the implementation reversal document, go to the tab VAT Sales.

Figure 9 VAT Register Sales

Figure 9 VAT Register Sales

We fill in the columns related to the additional sheet of the sales book. In the adjusted period column, enter the date from the third quarter.

Figure 10 VAT register adjustment

Figure 10 VAT register adjustment

In the Sales Book report, set the settings.

Figure 11 Sales Book report settings

Figure 11 Sales Book report settings

Additional sheets have appeared in the sales book.

Figure 12 Formation of new sections in the sales book

Figure 12 Formation of new sections in the sales book

An invoice has been reversed.

Figure 13 Additional sheet in the sales book

Figure 13 Additional sheet in the sales book

We fill out an updated VAT return. Be sure to indicate the correction number.

Figure 14 Updated VAT return

Figure 14 Updated VAT return

We fill out the declaration, we see the data in section 9.

Figure 15 VAT return, section 9

Figure 15 VAT return, section 9

Reversal of receipts in 1C 8.3

Example 4: the supplier's invoice was mistakenly posted twice - once in the advance report, the second as a goods receipt document. One of these receipts must be deleted. We will reverse the amounts under the second document.

Figure 16 Documents in the 1C program

Figure 16 Documents in the 1C program

The reversal of receipts in 1C 8.3 is formed according to the algorithm already discussed. In accounting, the amounts were reversed; in tax accounting for VAT, the situation is more complicated. Missing register VAT Purchases.

Figure 17 Reversal of document Receipt

Figure 17 Reversal of document Receipt

The invoice document, the primary one - not reversed, contains data that influences the formation of additional sheets of the purchase ledger.

Figure 18 VAT Register Purchases on invoice

Figure 18 VAT Register Purchases on invoice

There are several options for filling out the register VAT Purchases. You can click the button More add this register to the document (reversal Receipt) and fill it in manually.

Figure 19 Option for adding a VAT register

Figure 19 Option for adding a VAT register

Figure 20 Selecting a VAT register Purchases

This register can also be filled in automatically when reversing an invoice.

Figure 21 Filling in data to generate an additional sheet

Figure 21 Filling in data to generate an additional sheet

If the VAT register is filled out correctly, an additional sheet will appear when creating the purchase ledger.

Figure 22 Section with additional sheets in the purchase book

Figure 22 Section with additional sheets in the purchase book

When filling out the declaration, the data will be in section 8.

Figure 23 Updated VAT return, section 8

Figure 23 Updated VAT return, section 8

There are a couple more ways you can fill out additional sheets in the purchase book.

Method 1

Operations => Reflection of VAT for deduction

Figure 24 Menu path

Figure 24 Menu path

We indicate in the settings of this document that we are creating additional sheets and purchase book entries

Figure 25 Settings in the document

Figure 25 Settings in the document

On the tab Goods and services Click the Fill button to select an option Fill in according to the settlement document.

Figure 26 Selecting a filling option

Figure 26 Selecting a filling option

When filling out this section, by default the amounts are indicated as positive. We need to cancel the invoice, so we manually change the value Sum to negative, graphs VAT And Total will be recalculated automatically.

Figure 27 Generating document data

Figure 27 Generating document data

Method 2

Operations => Regular VAT operations

Figure 28 Menu path

Figure 28 Menu path

Then Create => VAT recovery

Figure 29 Selecting a document type

We indicate that the restoration must be reflected in the purchase ledger. A warning appears, click Yes.

Figure 30 Formation of a document

You can fill in the data manually using the button Add. By button Fill select an option Fill in the amounts to be restored. In this case, there is no need to change the amounts to negative values.

Figure 31 Selecting an option to fill out a document

The one who does nothing makes no mistakes. This truth is known to every accountant who has found accounting errors in a closed period. Reversal in 1C 8.3 Accounting is a way to correct such errors. Read how to make a reversal in 1C 8.3 in this article.

The accounting word “reversal” comes from the Italian “stornate” - to turn back. In posting language, this means creating accounting entries with a minus sign. Reversal in 1C is used in the following cases:

- corrections of errors in accounting;

- write-offs of realized trade mark-ups in retail trade;

- adjustments to the value of material assets;

- adjustments to valuation allowances.

In this article, you will learn how to correct accounting errors by reversing entries. For example, how to reverse a receipt from a previous period in 1C 8.3. Also here you will read how to reverse an implementation in 1C 8.3. Read on to learn how to make a reversal in 1C 8.3 in four steps.

Step 1. Create a “reversal of document” operation in 1C 8.3

Go to the “Operations” section (1) and click on the “Manually entered operations” link (2). A window will open for creating a “reversal of document” operation.In the window that opens, click the “Create” button (3) and click on the “Document Reversal” link (4). A form will open for filling out the “cancel document” operation.

In the window that opens, in the “Organization” field (5) indicate your organization, in the “Date” field (6) - the date of the operation.

In the window that opens, in the “Organization” field (5) indicate your organization, in the “Date” field (6) - the date of the operation.  Next, you can begin reversing various transactions. For example, to reverse a transaction for the receipt of goods (services).

Next, you can begin reversing various transactions. For example, to reverse a transaction for the receipt of goods (services).

Step 2. Perform an operation to reverse the receipt of the previous period

In the “Document Reversal” form there is a “Document Reversal” field (1). In this field on the right, click on the selection button “...”. A list of documents and transactions will open (2). To reverse the receipt of the previous period, select “Receipt (act, invoice)” (3) from this list. A window will open with a list of previously created receipt documents. In the window that opens, select the receipt invoice (4) that you want to cancel and click the “Select” button (5).

In the window that opens, select the receipt invoice (4) that you want to cancel and click the “Select” button (5).  After this, the “Accounting and tax accounting” (6) and “VAT presented” (7) tabs will appear at the bottom of the window. In the “Accounting and Tax Accounting” tab, you can see the entries (8) that were made in the erroneous document. The amounts in these transactions (9) are indicated with a minus sign.

After this, the “Accounting and tax accounting” (6) and “VAT presented” (7) tabs will appear at the bottom of the window. In the “Accounting and Tax Accounting” tab, you can see the entries (8) that were made in the erroneous document. The amounts in these transactions (9) are indicated with a minus sign.  In the “VAT presented” tab you can see the reversing entry for VAT registers (10).

In the “VAT presented” tab you can see the reversing entry for VAT registers (10).  Thus, the operation “Reversal of document” cancels entries in accounting and tax accounting for the selected receipt document. Entries in special 1C registers are also canceled.

Thus, the operation “Reversal of document” cancels entries in accounting and tax accounting for the selected receipt document. Entries in special 1C registers are also canceled. To complete the operation to reverse the receipt, click the “Record” button (11). Now reversing entries are reflected in accounting 1C 8.3 Accounting. In order to print an accounting certificate for a reversing transaction, click the “Accounting certificate” button (12). A printable help form will open.

In the printed help form, click the “Print” button (13).

In the printed help form, click the “Print” button (13).

Step 3. Reverse the implementation in 1C 8.3

Create a reversal transaction as in step 1 of this article. In the “Document to be canceled” (1) field, select “Sales (deed, invoice)” (2). A window will open with a list of previously created implementations. From the list, select the sale you want to reverse (3). The “Accounting and Tax Accounting” and “VAT Sales” tabs with reversing entries will appear at the bottom of the window.

From the list, select the sale you want to reverse (3). The “Accounting and Tax Accounting” and “VAT Sales” tabs with reversing entries will appear at the bottom of the window.  In the “Accounting and Tax Accounting” tab, you can see the entries (4) that were made in the erroneous document. The amounts in these transactions (5) are indicated with a minus sign.

In the “Accounting and Tax Accounting” tab, you can see the entries (4) that were made in the erroneous document. The amounts in these transactions (5) are indicated with a minus sign.  In the “VAT Sales” tab (6) you can see the reversing entry for VAT registers (7).

In the “VAT Sales” tab (6) you can see the reversing entry for VAT registers (7).  To complete the operation of reversing the sale, click the “Write” button (8). Now reversing entries are reflected in accounting 1C 8.3 Accounting. Read how to print an accounting certificate in step 2 of this article.

To complete the operation of reversing the sale, click the “Write” button (8). Now reversing entries are reflected in accounting 1C 8.3 Accounting. Read how to print an accounting certificate in step 2 of this article.

Step 4. Don’t forget to submit updated tax returns after correcting errors in the closed period

If you reversed data from a previous tax period, you will need to submit corrective tax returns. We remind you that tax clarifications are submitted for the period in which erroneous entries were made.The demonstration was carried out using the example of the 1C: Enterprise Accounting 3.0 configuration (in other 1C: Enterprise 8.3 configurations the algorithm is the same).

Let's say there is a sales document that has the following postings:

We need to cancel the document. Before showing the correct method, I will show the incorrect one (since it is very common and it is necessary to dwell on it in detail).

Wrong way

We will reverse using manual operation:

In the list of documents that opens, select Create, type Operation:

We fill out the header of the document, then indicate the transactions (the same as in the sales document, but with a minus):

We record the document.

THIS IS A BAD MISTAKE!

Let's look again at the sales document movements:

As you can see, this document, in addition to postings, makes movements in accumulation registers VAT Sales And Sales of services. Moreover, the first register is directly responsible for the formation of the sales book.

As a result of a manual operation, we removed the document entries, but the entry in the purchase book still remained - this was an error. When reversing documents, we must reverse ALL document movement.

The right way

We also use the document Manual operation:

But unlike the first option, when creating a new document, select the type Reversal of document:

The program asks you to select the type of document to be reversed:

Now select the required sales document:

The document is filled out automatically, and it now reverses all movements of the original document:

To activate postings, do not forget to write down the document.

Reversal of other types of documents must be performed in the same way.

To achieve the necessary goals, we are interested in the last possible point.

When we click on the Create button, you can see the types of the Operation document. From the drop-down submenu you must select the type of document reversal:

In the newly created document, you need to select an organization (if the 1C 8.3 information base keeps records of several organizations), and also select the “erroneous” document itself, having first selected its type:

Let's look at a small example of how to reverse an implementation in 1C 8.3 of the previous period.

Let’s say that in June an organization sold goods in the amount of 17,700 rubles, including VAT of 2,700 rubles. The sales operation was formalized with the document Sales of goods (acts, invoices) dated June 23, 2016:

The document created the postings:

As well as movement according to the sales VAT register:

An invoice was generated for the document:

As soon as we issue an invoice, VAT on the sale of goods will be reflected in the Sales Book:

In July it turned out that the goods had not been shipped. There was a need to adjust the closed period and reverse the implementation in 1C 8.3.

As discussed earlier, we will use the reversal document mechanism in 1C 8.3. As soon as we select an organization, the “erroneous” implementation document will automatically appear:

- Text of the document details “Contents”;

- Postings with negative values:

Also, a reversing entry in the VAT Sales register has been created. In order for it to be included in the additional sheet of the Sales Book, we set the values:

- Recording an additional sheet – “Yes”;

- The adjusted period is “06/23/2016”;

- Reversing entry additional. sheet - “Yes”:

How to register the movement in tax accounting and in the VAT accumulation registers for a reversed transaction, see our video lesson:

Having created canceling transactions and adjusted the register, we try to assemble the Sales Book, having previously configured its presentation in 1C 8.3:

Now you can see the result of the actions taken:

How to change an information register entry in 1C 8.3

Let's look at a small example. Let's say June 24, 2016. the fixed asset was taken into account. The initial information was filled in, in which an error was made - the useful life was incorrectly indicated as 68 months instead of 60:

The DtKt button shows the movement of the document, including in the information registers: Asset depreciation parameters (accounting), Asset depreciation parameters (tax accounting):

To adjust the register of information, we use an already familiar document Transactions – Transactions entered manually. The difference is that we select the Operation type:

We indicate the organization and click on the “More” button:

We select the necessary information registers for adjustment:

We create adjusting entries for the fixed asset:

In order to verify the correctness of the information on a fixed asset after changes to the information register entry in 1C 8.3, we will generate a universal report, indicating the information register OS depreciation parameters (accounting) and OS depreciation parameters (tax accounting):

For more details on how you can reverse a document in 1C, see our video tutorial:

Please rate this article:

In practice, there are situations when accounting erroneously reflects the receipt of goods (work, services) that did not take place in the economic life of the organization. In this case, such an operation is not subject to adjustment, but to cancellation.

Deleting an erroneous receipt document for the current year

In practice, there are situations when accounting erroneously reflects the receipt of goods (work, services) that did not take place in the economic life of the organization. In this case, such an operation is not subject to adjustment, but to cancellation.Example 1

The organization New Interior LLC in February 2016 discovered an erroneously recorded transaction for the purchase of repair work for an industrial premises from a contractor (in the amount of 20,000 rubles) and an erroneous registration entry in the purchase book for the third quarter of 2015 (in the amount of 3,600 rubles .). These amounts were not paid to the supplier. This error was discovered before the submission of the income tax return for 2015 and before the signing of the financial statements for 2015. The organization makes the necessary corrections to the accounting and tax records and submits updated tax returns to the tax authority: for VAT - for the third quarter of 2015; for income tax - for 9 months of 2015.The cost of repair work erroneously reflected in accounting was registered in the program in September 2015 by document Receipt (act, invoice) with the type of operation Services (act). After posting the document, the following entries were entered into the accounting register:

Debit 25 Credit 60.01

Debit 19.04 Credit 60.01 Based on the receipt document, a document was registered Invoice received, and VAT is accepted for deduction in full in the period of receipt of services. The corresponding entries are entered in the program into the accounting register and into special VAT accounting registers.The erroneously recorded cost of repair work was fully accounted for as direct expenses in September 2015.

Correction of a mistake made in reflecting in accounting and tax accounting a fact of economic life that did not take place is registered in “1C: Accounting 8” edition 3.0 using the document Operation with a view Reversal of document(Fig. 1). The document is accessed from the section Operations via hyperlink Transactions entered manually.

Rice. 1. “Reversal” of the receipt document

The header of the document states:

- in field from- date when the error was corrected. In Example 1, the bug is fixed in December 2015;

- in field Cancellable document- corresponding erroneous receipt document;

- field Content and tabular parts of the document are filled in automatically after selecting the document to be reversed.

REVERSE Debit 25 Credit 60.01

- for the cost of repair work performed (RUB 20,000);

- for the amount of submitted input VAT (RUB 3,600).

Since the cancellation of a registration entry for an erroneously issued invoice must be made in an additional sheet of the purchase book for the third quarter of 2015, the corresponding reversal entries must be entered into the register VAT Purchases.

Canceling an erroneous invoice entry from the purchase ledger is done using the document Reflection of VAT for deduction(chapter Operations) by button Create.

After processing Closing the month for December 2015, when reporting is automatically completed, the corrected accounting and tax accounting data will appear both in the annual financial statements and in the corporate income tax return for 2015. The updated profit declaration for 9 months of 2015 will have to be adjusted manually. To do this, the automatically filled in indicator of line 010 “Direct expenses related to sold goods (products), works, services” of Appendix No. 2 to Sheet 02 of the income tax declaration should be reduced by 20,000 rubles.

Deleting an erroneous receipt document from last year

The situation when you need to cancel a previous year’s admission document is more complicated.

Example 2

The erroneously recorded transaction described in Example 3 was discovered after the submission of the income tax return for 2015 and after the signing of the financial statements for 2015. The organization makes the necessary changes to the accounting and tax records and submits updated tax returns to the tax authority: for VAT - for the third quarter of 2015; for income tax - for 9 months of 2015 and for 2015.To correct the error of previous years in reflecting in accounting and tax accounting a fact of economic life that did not take place, you can use the correction technique implemented in the document Adjustment of receipts and described in Example 2. To do this, two documents should be generated in the program Operation, relating to different periods:

- dated September 2015 - only for adjusting tax accounting data for income tax;

- with a view Reversal of the document dated February 2016, - to adjust accounting data and tax accounting data for VAT.

REVERSE Amount NU Dt 90.02.1 Amount NU Kt 76.K

- for the amount of erroneously reflected direct costs;

- the amount of the financial result obtained as a result of corrections made to tax accounting.

Rice. 2. Adjustment of last year’s data in tax accounting

Now, when automatically filling out reports, tax accounting data adjusted in the previous period will appear both in the updated income tax return for 9 months of 2015, and in the updated income tax return for 2015.

After this, you need to perform the routine operation again Balance reform, included in the processing Closing of the month.

When created in February 2016 Operations, with a view Reversal of document automatically filled tabular part on the tab Accounting and tax accounting(see Fig. 3) must be adjusted as follows (Fig. 3):

- Replace the entry REVERSE Debit 25 Credit 60.01 with the entry Debit 60.01 Credit 91.01 and reflect the amount of income from the previous period (20,000 rubles). In a special resource for tax accounting purposes, it is necessary to reflect the constant difference: Amount PR Dt 60.01 Amount PR Kt 91.01;

- in special resources for tax accounting purposes, add the entry Amount NU Dt 60.01 Amount NU Kt 76.K and reflect the repayment of debt on settlements with counterparties for the transaction that was subject to adjustment (20,000 rubles).

Rice. 3. Reflection of income from previous years in accounting and cancellation of the receipt document regarding VAT

The automatically filled in VAT tab presented will be left unchanged. In terms of VAT, the cancellation of an erroneous registration entry for an invoice from the purchase book for the third quarter is carried out similarly to the procedure described in Example 1.